Learning how to fill out a 1040 form helps individuals report income, claim deductions, and calculate taxes correctly while maximizing refunds and avoiding IRS errors.

Table of Contents

-

Introduction: Why the 1040 Form Is Important

-

What is 1040 Tax Form?

-

Step-by-Step Guide to Fill Out a 1040 Form

-

Personal Information

-

Filing Status

-

Income Section

-

Adjustments and Deductions

-

Tax Calculation

-

Payments and Refund

-

-

Important Schedules

-

Form 1040 Schedule 3

-

Schedule B Form 1040

-

-

Special Forms: 1040-NR Form

-

Completed 1040 Form Example - PDF

-

Common Mistakes to Avoid

-

Tax Price and Professional Help

-

Practical Tips from BooksMerge

-

Conclusion

-

FAQ

1. Introduction: Why the 1040 Form Is Important?

Filing taxes can feel like navigating a maze blindfolded. The 1040 form is the cornerstone of individual tax reporting in the U.S., and errors can delay refunds or trigger IRS notices.

From reporting wages to claiming deductions and credits, IRS Form 1040 consolidates your financial activity for the year. Learning how to fill out a 1040 form ensures accuracy, maximizes eligible deductions, and minimizes stress.

At BooksMerge, we help individuals and small businesses complete this form correctly, reducing errors and maximizing refunds. Call +1-866-513-4656 for expert assistance.

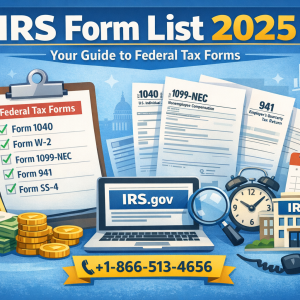

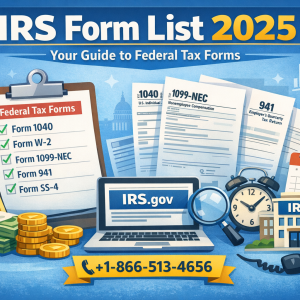

2. What is 1040 Tax Form?

The 1040 tax form is the standard IRS document used by U.S. citizens and residents to report income, calculate taxes owed, and claim deductions and credits.

Key points:

-

Includes wages, interest, dividends, self-employment income, and retirement distributions

-

Allows taxpayers to claim deductions and credits

-

Determines whether you owe additional taxes or receive a refund

Understanding the 1040 form prevents mistakes and ensures you claim all eligible tax benefits.

3. Step-by-Step Guide to Fill Out a 1040 Form

Personal Information

Enter your full name, Social Security number, and mailing address. For joint filers, include your spouse’s details. Double-check all entries, as incorrect SSNs are a common cause of IRS delays.

Filing Status

Choose one of the five filing statuses:

-

Single

-

Married Filing Jointly

-

Married Filing Separately

-

Head of Household

-

Qualifying Widow(er)

Your filing status impacts your standard deduction, tax rates, and eligibility for certain credits.

Income Section

Report all sources of income: wages, interest, dividends, business income, and other taxable income. Use Schedule B Form 1040 if interest and dividend income exceed $1,500 or you hold foreign accounts.

Adjustments and Deductions

Include adjustments like IRA contributions, student loan interest, educator expenses, and moving expenses if applicable. Use Form 1040 Schedule 3 to claim nonrefundable credits such as education or foreign tax credits.

Tax Calculation

After totaling your income and subtracting deductions, calculate your taxable income and apply the appropriate tax rate. Include tax credits and prior payments.

Payments and Refund

Include amounts withheld from W-2s, estimated payments, and refundable credits. Your total determines whether you owe taxes or are eligible for a refund.

4. Important Schedules

Form 1040 Schedule 3

Schedule 3 is used for nonrefundable credits such as education, foreign tax, and general business credits. Proper documentation is required to substantiate claims.

Schedule B Form 1040

Schedule B is used to report interest and ordinary dividends if they exceed $1,500 or if you have foreign accounts. Correctly completing this schedule ensures compliance with IRS rules.

5. Special Forms: 1040-NR Form

The 1040-NR form is for non-resident aliens with U.S.-source income. It follows the general structure of Form 1040 but includes special rules for treaty benefits, withholding, and eligible deductions.

Non-residents must pay attention to deductions and credits available under applicable tax treaties to minimize liability.

6. Completed 1040 Form Example - PDF

Viewing a completed 1040 form example - PDF can help first-time filers understand how numbers flow through the form. BooksMerge provides guidance to ensure your completed forms match IRS expectations and reduce mistakes.

7. Common Mistakes to Avoid

-

Entering incorrect Social Security numbers or names

-

Forgetting to attach schedules

-

Misreporting income from multiple sources

-

Claiming credits without proper documentation

-

Calculation errors

Avoiding these mistakes ensures your return is processed quickly and correctly.

8. Tax Price and Professional Help

Many people underestimate the tax price of mistakes or missed deductions. Errors can cost hundreds or even thousands in lost refunds or penalties.

Professional assistance offers:

-

Correct form completion

-

Maximized deductions and credits

-

Reduced audit risk

At BooksMerge, we offer accurate 1040 preparation at competitive rates. Call +1-866-513-4656 for your personalized tax price and expert support.

9. Practical Tips from BooksMerge

-

Gather all W-2s, 1099s, and supporting documents early

-

Keep digital copies of each financial record

-

Use schedule B and schedule 3 correctly to maximize credits

-

Review your completed 1040 form example before submission

-

Consider professional help for complex situations

Following these tips ensures your tax filing is smooth, accurate, and optimized.

10. Conclusion

Filing a 1040 form doesn’t have to be stressful. Understanding what is 1040 tax form, correctly using schedules, and following step-by-step instructions ensures proper reporting, maximizes refunds, and avoids errors.

BooksMerge simplifies the process, offering guidance on IRS Form 1040, completed examples, and schedules. Contact +1-866-513-4656 for expert assistance and file your taxes confidently.

FAQ

What is 1040 tax form?

It is the IRS document used to report income, calculate taxes owed, and claim deductions or credits.

What is Form 1040 Schedule 3 used for?

Schedule 3 reports nonrefundable credits such as education, foreign tax, and business credits.

When do I need Schedule B Form 1040?

If your interest and ordinary dividends exceed $1,500 or if you hold foreign accounts.

What is 1040-NR form?

For non-resident aliens with U.S.-source income and special withholding/treaty provisions.

Where can I find a completed 1040 form example - PDF?

BooksMerge provides examples and guidance for accurate completion.

How much does professional help cost?

Pricing varies, but BooksMerge offers competitive rates. Call +1-866-513-4656 for your tax price.

Read Also: Form 6765 Instructions